Tips for reducing debt and increasing savings are the very important thing to do to maintain your financial balance. In this article, we will learn tips to reduce debt to increase savings.

Effective management of the net worth and other income finances would greatly impact building a strong savings portfolio. Let’s come to the tips quickly; keep reading the article.

Create A Budget

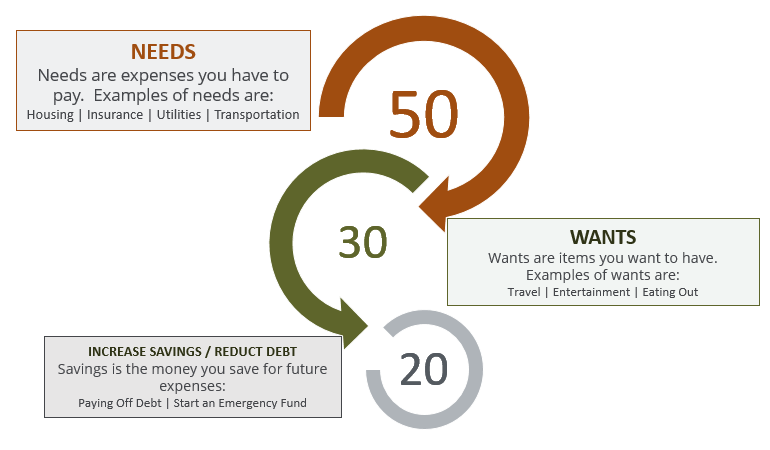

Creating a budget is a foremost tip for saving income and reducing debts. To create the budget, follow the first step to maintain financial stability. Here it would help if you listed your expenses and debts you wouldn’t pay.

Doing this lets you identify the expenses and create a realistic budget. After creating a budget, you should stick to it. You will more control over your finances. You can also prioritize the off debt and increase your savings.

Pay Off High-Interest Debt First

High-interest debt means a credit card debt that needs to pay first. You can quickly accumulate debts that seem difficult to manage. It’s very significant when you prioritize paying off high-interest debt first.

The amount of interest can significantly increase the money over time. By focusing on paying off high-interest debt. You can decrease the expenses and save more money or interest charges.

Consolidate Debt

Consolidating the debt can reduce the interest you pay to simplify your payment. Debt consolidation revolves around loan withdrawal payments and multiple debts payment. This results in a lower interest rate or mono monthly income. All the steps make it easier to manage the debt.

Reduce Expenses

Reducing your expenses means your money will be free for debt repayments and savings. Some ways to reduce expenses are cutting back on dining out and canceling subscriptions. Negotiating bills is also a part of reducing expenses.

Create A Reserve Fund

You may guard against unforeseen costs and monetary problems by setting up an emergency fund. Try to keep three to six months’ worth of spending in a simple account, like a savings account.

Increase Retirement Contributions

Making the most of your retirement contributions can improve your future financial security. Consider making 401(k) or IRA contributions and utilizing workplace matching programs.

Set Reasonable Objectives

You may maintain your motivation and concentrate on debt repayment and savings growth by setting realistic goals. Be careful to create specific, attainable goals and assess your progress routinely.

Is It Preferable to Prioritize Saving Money Over Paying Off Debt?

It depends on the specifics of your situation. In general, it’s advisable to prioritize paying off high-interest debt first. If you want to guard against unforeseen bills, building an emergency fund is crucial.

What about Debt Consolidation?

Debt consolidation may be useful for lowering interest rates and streamlining payments. It’s crucial to analyze any consolidation loan’s conditions and costs carefully.

How can I Lower My Spending?

Reducing pointless purchases, terminating subscriptions, and negotiating bills can help you save money. You can find areas to save by budgeting and tracking your expenses.

What Should I do If My Salary doesn’t Rise?

Focus on cutting back on spending and taking advantage of any possibilities to save money if you cannot boost your income. Either downsizing or figuring out how to add passive income streams to your current income.

Conclusion

Financial stability can only be attained by reducing debt and raising savings. Practical advice includes:

- Making a budget.

- Paying off high-interest debts first.

- Consolidating debt.

- Lowering expenses.

- Raising income.

- Putting money aside for an emergency.

- Maximizing retirement contributions.

- Setting reasonable goals.

To keep motivated, it’s critical to prioritize paying off high-interest debt first, accumulate an emergency fund, and create attainable goals.

You may grow your savings and pay off debt more quickly by cutting costs, raising your income, and making the most of your retirement contributions. You may achieve financial stability and ensure a better future by implementing these suggestions.